Actively reform tax administration, accompany enterprises

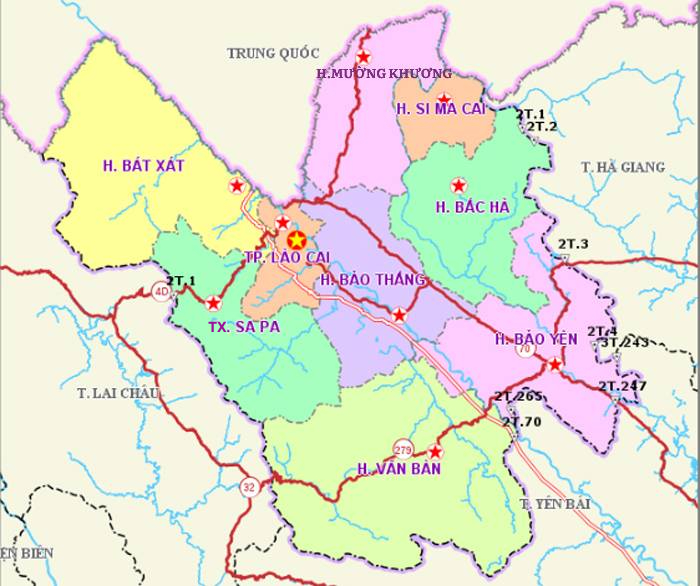

According to the evaluation of businesses operating in the province, in recent years, the Lao Cai tax industry has had many solutions to reform tax administrative procedures, creating favorable conditions for companies to develop.Reduce nearly 100 administrative procedures

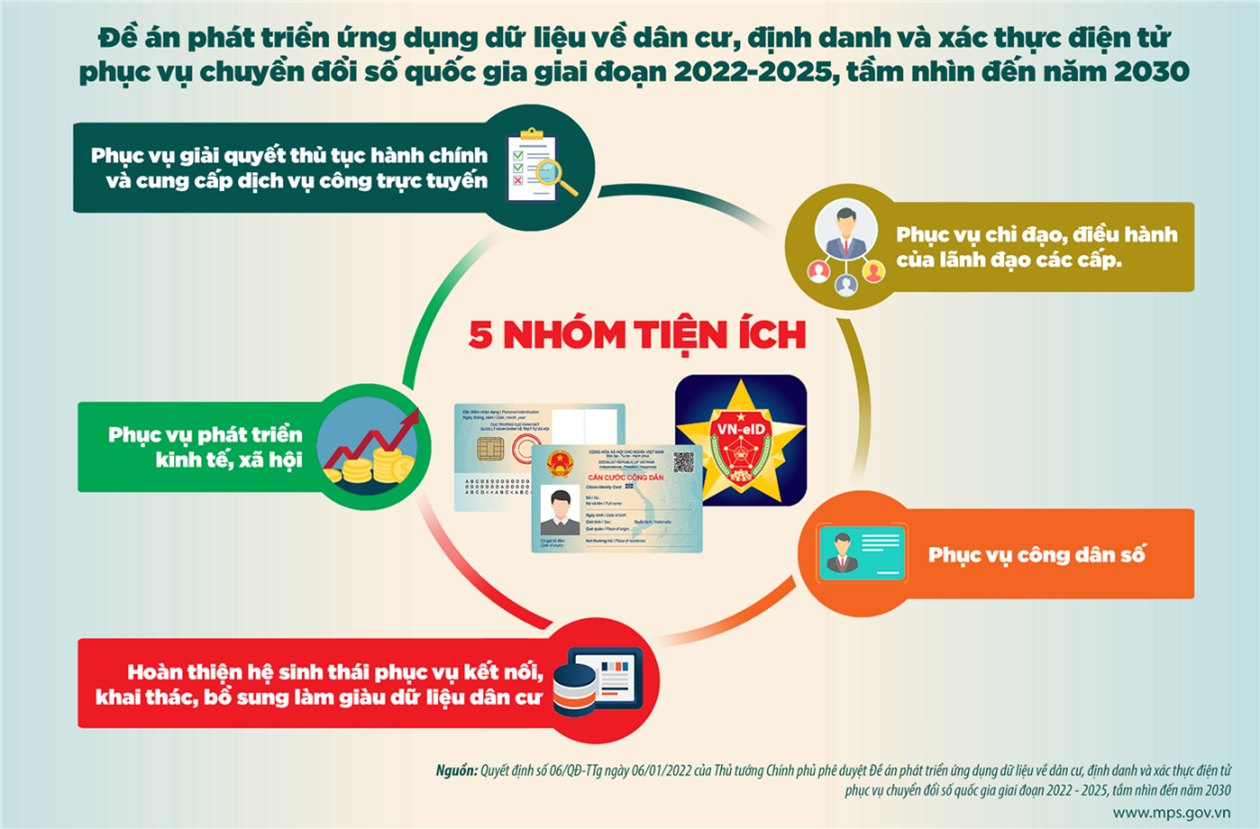

Administrative procedure reform (TTHC) is a regular task that the tax industry has always focused. The focus of administrative reform is to reduce, simplify, and electronic, managerial procedures to create the most favorable conditions for the people to effectuate tax rights and obligations with the state budget. Along with the application of information technology and streamlining of the apparatus, the tax industry also synchronously deployed many solutions to reform administrative procedures to reduce time, costs, and maximize convenience for businesses when completing tax procedures.

|

|

The Provincial Tax Department actively supports taxpayers affected by Covid-19 Epidemic. |

According to the statistics of the Provincial Tax Department, the number of administrative procedures is now 290. In which, the Tax Department 166 systems, the tax department 124 processes, reduced 94 methods compared to 2015. Most corporate tax administrative procedures are done electronically through the web portal of the tax authority and the National Public Service Portal; Specifically, 176/290 TTHC provided online reaches level 3, level 4 with 100% of enterprises participating in electronic tax declaration. The tax industry has cooperated with 15 commercial banks to deploy electronic tax payment services, with the total number of enterprises registered to pay electronic tax at 99.2%. The electronic tax refund is also promoted by the provincial Tax Department, with 100% of VAT refund dossiers being processed electronically. To ensure the successful implementation of Decree No. 119 dated September 12, 2018, of the Government on electronic invoices when selling goods and providing services, the Provincial Tax Department has expanded electronic invoices for businesses, organizations, business households, and individuals business in the province. As of August 30, 2020, 710 enterprises announced the use of electronic invoices.

From August 1, 2020, taxpayers registering cars and motorcycles in the province can pay the electronic registration fee through the Government National Public Service Portal and the government's online payment channels. Vietcombank, VietinBank, Agribank, VPBank, MBbank, BIDV ...

The complicated time of the Covid-19 Disease is also the peak month for the finalization of corporate income tax and personal income tax in 2019. The provincial tax department has many forms of supporting taxpayers and receiving tax settlement records through the post office and electronic.

Solving difficulties for businesses affected by the Covid-19 Disease

Lao Cai International Hotel Joint Venture Company Limited is one of the significant contributors to the local budget. At one point, the enterprise paid 17-18 billion dongs/month to the fund. However, the Covid-19 epidemic makes businesses difficult. The customer segment is mainly foreigners. Many times companies have to let employees take turns. To share the company's difficulties, the Provincial Tax Department extended the tax payment time with the amount of nearly 1.8 billion VND. Similarly, MTV ACT Company Limited is also extended the tax payment period with the amount of 4.1 billion VND. Those are just 2 out of hundreds of businesses facing difficulties joined by the Provincial Tax Department to remove and accompany during the time affected by the Covid-19 disease.

Implementing the support according to Decree 41/2020 / ND-CP, as of the end of August 2020, there are 430 enterprises in the province accepted to be extended with the total tax amount, land rent is inflated 96 billions dong; 268 business households (out of 475 families applying for appraisal) are supported under the Government's Resolution 42. Decree 41 and Resolution 42 are implemented by the Provincial Tax Department following regulations.

In particular, to promptly remove difficulties for taxpayers damaged by the Covid-19 disease, the Provincial Tax Department strengthened the propagation and support in various forms on the extension, support, and exemption policies by the Government due to the condition. For example, the Provincial Tax Department cooperates with the Department of Information and Communications, the provincial news agencies and radio to promote propaganda on policies on extension of tax payment, land rent; support policies for individual business households, tax exemption and reduction policies according to decrees and resolutions of the Government. In particular, on May 14, 2020, the Provincial Tax Department cooperated with the Provincial Radio - Television to organize a direct dialogue program on the Government's extension and support policies on Radio - Television. Provincial figure.

After the Government issued decrees and resolutions, the provincial Tax Department issued a notice to businesses, organizations, households, and individuals engaged in production and place in the above taxpayer's province. Localities know and execute. At the same time, post all the content of the Government's notice and decrees and resolutions on the province's website and website at the address: Http// laocai.gdt.gov.vn for taxpayers to access. Besides, the Provincial Tax Department texted 3,269 taxpayers with 9,358 text messages to directors and accountants about the Government's extension, support, and exemption policies.

Along with the propaganda, in the implementation of the policies on extension of tax payment, land rental, the Government's support and reduction policies, the Provincial Tax Department strengthens support activities for taxpayers. . By the end of August 2020, the Lao Cai Tax Department has supported more than 2,000 taxpayers regarding the content of the Government's extension, support, exemption policies. The Tax Department promptly provides and thoroughly guides the procedures for deferring payment, how to prepare, and send a request for tax deferral and exemption documents on the system thuedientu.gdt.gov.vn and the Service Portal national public sector following regulations.

According to the survey and polls of taxpayers about the support in implementing the Government's policies on extension, approval, exemption, or reduction, the provincial Tax Department receives the most positive feedback from the business, taxpayers to support those affected by Covid-19 disease.